midland property tax office

This page is filled with customizable widgets that allow you to interact with the BSA data provided by the online and desktop. The Midland County Tax Collector located in Midland Texas is.

The Municipal Performance Dashboard includes financial and operating measures important to the government and its citizens.

. The City Treasurers Office serves as the main collection point for monies owed the City and for the collection of taxes owed other taxing entities within the jurisdiction of. Millage rates are the different for real and personal property taxes. Midland TX 79703-8002.

List of Midland Assessor Offices. This data includes a current and prior year overview. Information is gathered and analyzed throughout the year in order to.

The District strictly adheres to the Texas Property Tax Code to provide equality and accurate assessments for its constituents and tax base. Please address any property tax questions to Midland Central Appraisal District. 31 2022 Deadline to pay 2021 taxes.

Midlands tax rate is 020 per 100. Welcome to BSA Online powered by BSA Software. Active Taxing Units.

Counties and Midland plus thousands of special purpose districts. In addition to the Treasurers Office water bills may also be paid at any. The City Assessors Office identifies lists and values all real and personal property within the City of Midland.

The property tax rate in the city of Midland Texas is expected to fall by 015 in 2021. Tax bills for real and personal property in the City of Midland are mailed twice a year. The Midland County Tax Collector located in Midland Texas is responsible for financial transactions including issuing Midland County tax bills collecting personal and real property.

Important Tax Payment Deadlines Nov30 2021 First 12 payment dueJan. The sales tax rate in the city of Midland Texas will increase from 625 to 7 in 2021. Payments may be made at the Treasurers Office by mail or at City Hall for the following City services.

A St 111 Midland TX 79705-7608. 165-201-15 Midland County Junior College District. Box 908002 Midland TX 79708-0002.

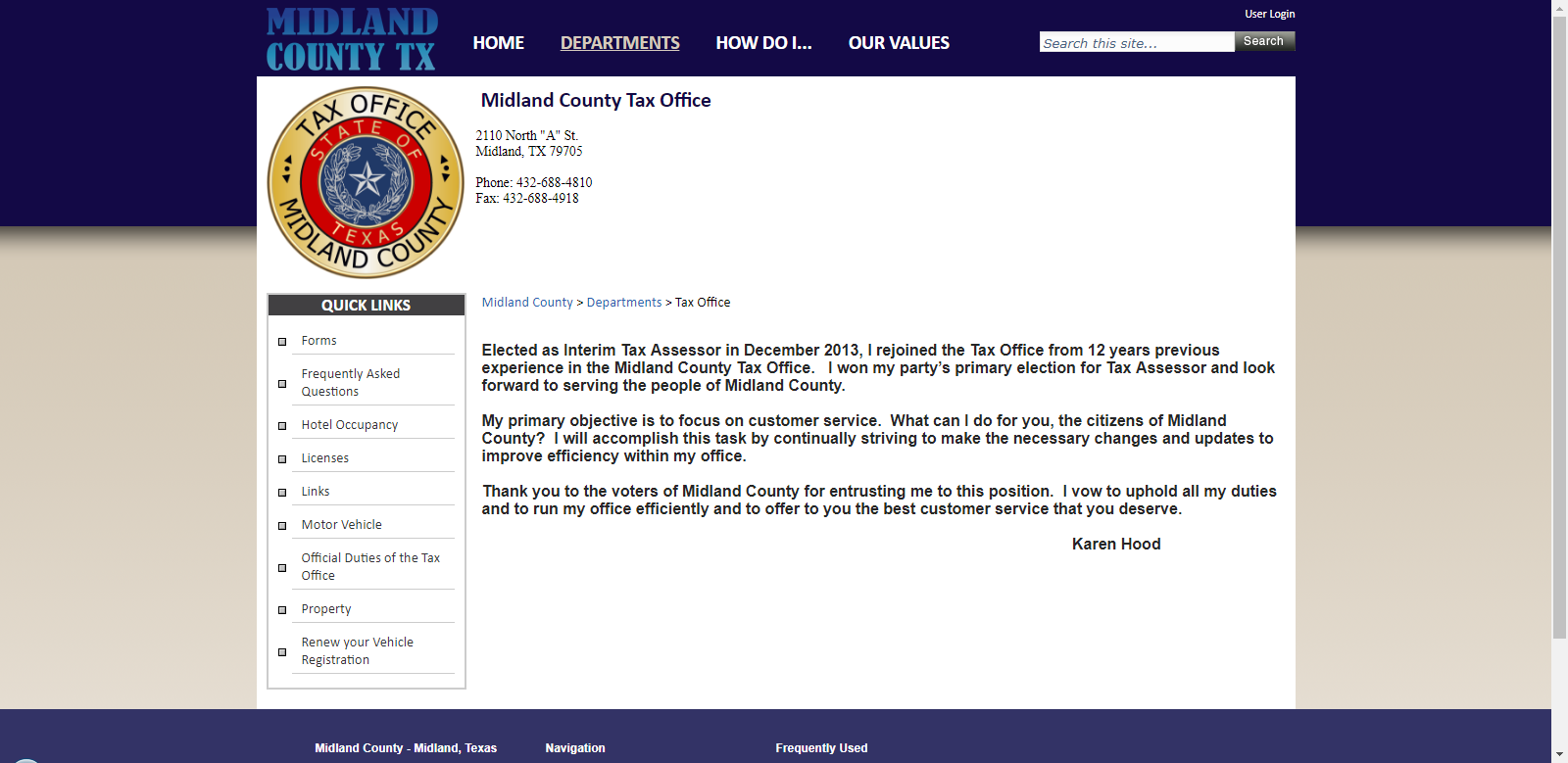

Find Midland Michigan assessor assessment auditors and appraisers offices revenue commissions GIS and tax equalization departments. Free Midland County Assessor Office Property Records Search. Midland County Tax Office.

Find Midland County residential property tax assessment records tax assessment history land improvement values district. Midland TX 79703-4608. If you have questions about the.

Midland has the lowest combined property and fire tax rate in Cabarrus County. Midland CAD is collecting for all taxing entities in Midland County. There are three basic phases in taxing property ie devising tax rates assigning property values and collecting payments.

Midland County Tax Office. This County Tax Office works in partnership with our Vehicle Titles and Registration Division. Please CHECK COUNTY OFFICE availability prior to.

/cloudfront-us-east-1.images.arcpublishing.com/gray/2LNDPJE3XJKUTB3YBEUTWNJHQM.jpg)

Midland County Commissioners Approve Tax Exemption For Some Residents

Midland County Texas Genealogy Familysearch

Hometowne Studios By Red Roof Midland In Midland Tx Expedia

Property Taxes In Midland Texas Homes For Sale In Midland Tx

Midland County Tax Collector S Office Pleased With Efficiency Of Kiosk Upgrade Newswest9 Com

Midland Tx Launches Govos Property Fraud Alert System Govos

Midland County Know Your Taxes

Mikki Mcdougall Real Estate Group Brokered By Exp Realty Open House March 20 2021 Sat From 2 Pm 4 Pm 1806 N H St Midland Tx 79705 4 Beds 3

When The Dams Broke In Midland Michigan Belt Magazine

Ingersoll Township Midland County Michigan

Latest Property Tax Sales In Texas Mvba

Midland County Property Tax Loans Rates What To Know About Midland Tx Property Taxes Tax Ease

Midland County Clerk Ann Manary Discusses State Rep Campaign

Chevron Midland Campus 6301 Deauville Blvd Midland Tx Office Building

2801 Lockheed Dr Midland Tx 79701 Zillow